- ●एस.बी.आई के बाद पी.एन.बी बना दूसरा बड़ा बैंक, सरकारी बैंकों की संख्या घट कर हुई १२

- ●केरल में लहराया पाकिस्तानी झंडा, ३० से ज्यादा छात्रों पर मुकदमा दर्ज

- ●यूपीएससी २०१९ मेन्स परीक्षा के एडमिट कार्ड जारी, ऐसे करें डाउनलोड

- ●हरतालिका तीज व्रत और पूजन तिथि

- ●अमृता प्रीतम की १००वीं जयंती आज

- ●बेरोजगारों के लिए योगी सरकार लगा रहीं रोजगार मेला

- ●महाराष्ट्र के एक केमिकल फैक्ट्री में आग, ८ लोगों की मौत

- ●असम : गृह मंत्रालय ने जारी की एन.आर.सी की फाइनल लिस्ट

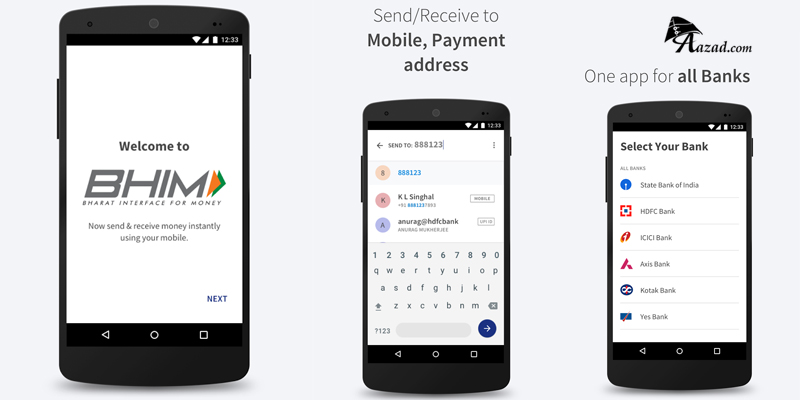

How To Use the BHIM Mobile App For Money Transfer

Bharat Interface for Money (BHIM) is an initiative to enable fast, secure, reliable cashless payments through your mobile phone. BHIM is interoperable with other Unified Payment Interface (UPI) applications, and bank accounts for quick money transfers. BHIM is developed by the National Payment Corporation of India (NPCI). BHIM is made in India and dedicated to the service of the nation.

How Does it Work?

Register your bank account with BHIM, and set a UPI PIN for the bank account. Your mobile number is your Payment Address, and you can simply start transacting. Yes! It is that simple.

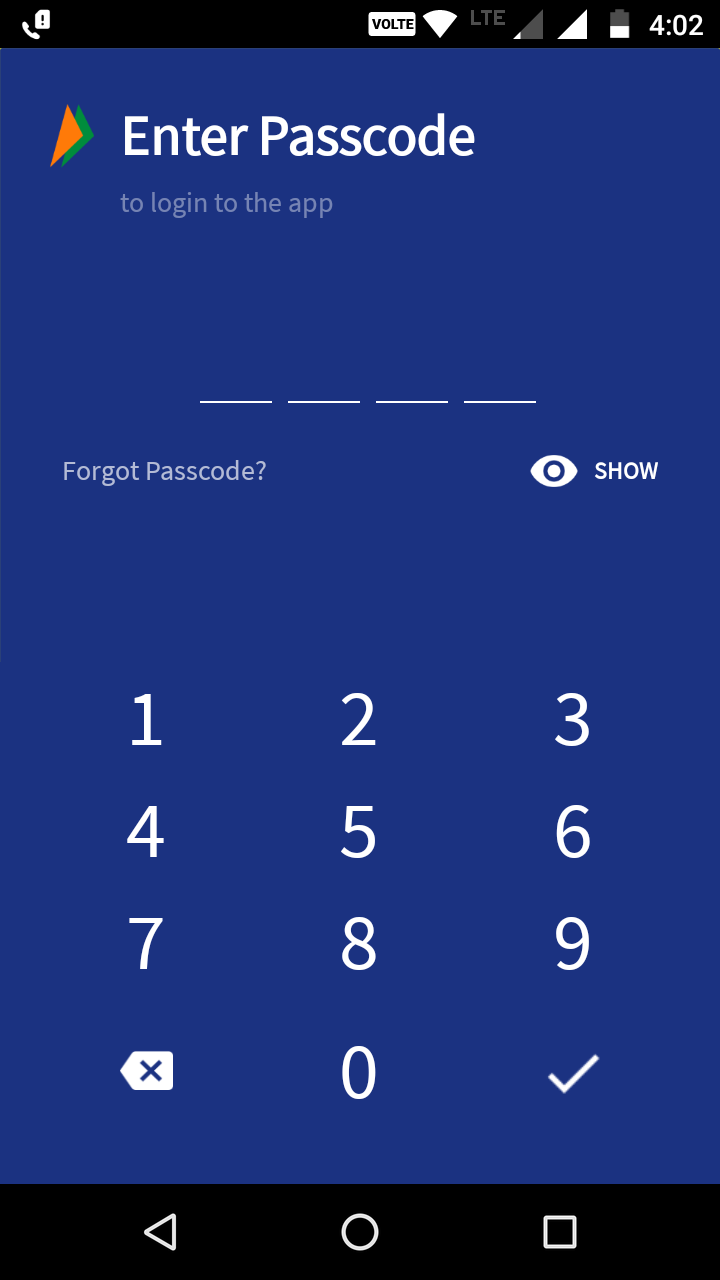

Download the BHIM App from Google Playstore or Apple Appstore and Open the App

Download the BHIM App from Google Playstore or Apple Appstore and Open the App

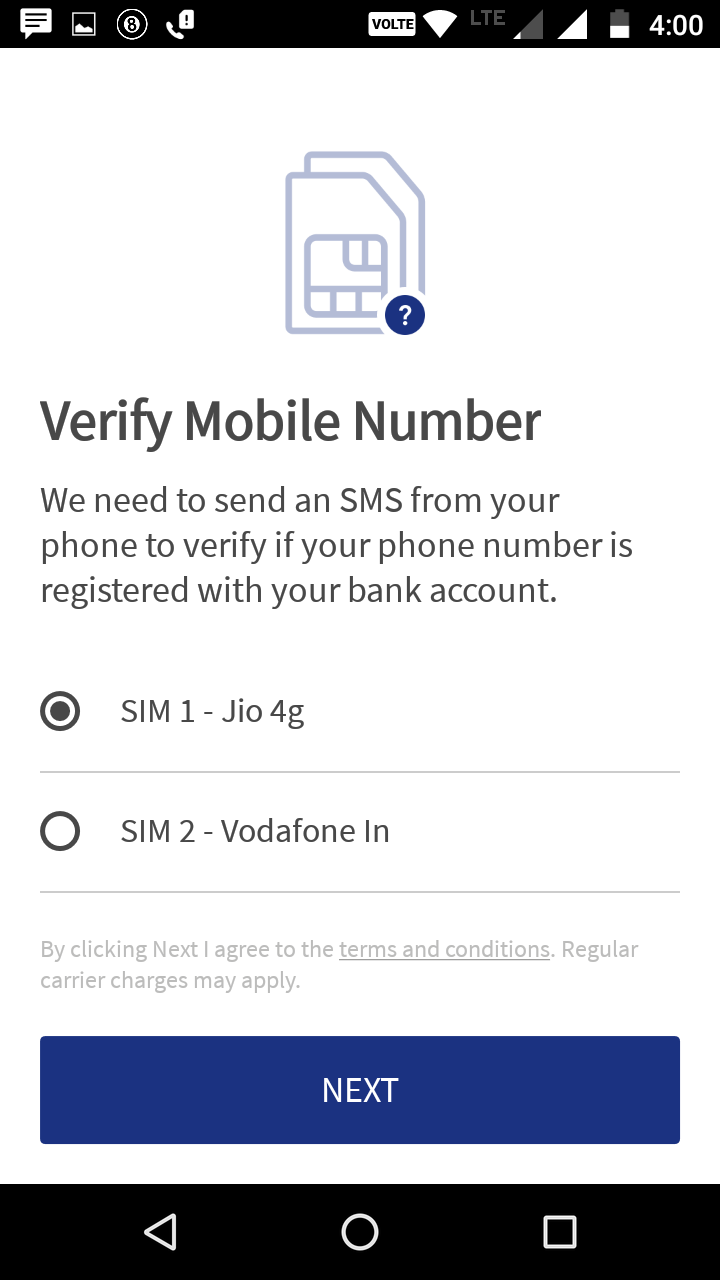

Select the SIM Card that has the number affiliated with your Bank Account in case you are using Dual Sim Phone. Grant access to calls and messages for mobile number verification.

Select the SIM Card that has the number affiliated with your Bank Account in case you are using Dual Sim Phone. Grant access to calls and messages for mobile number verification.

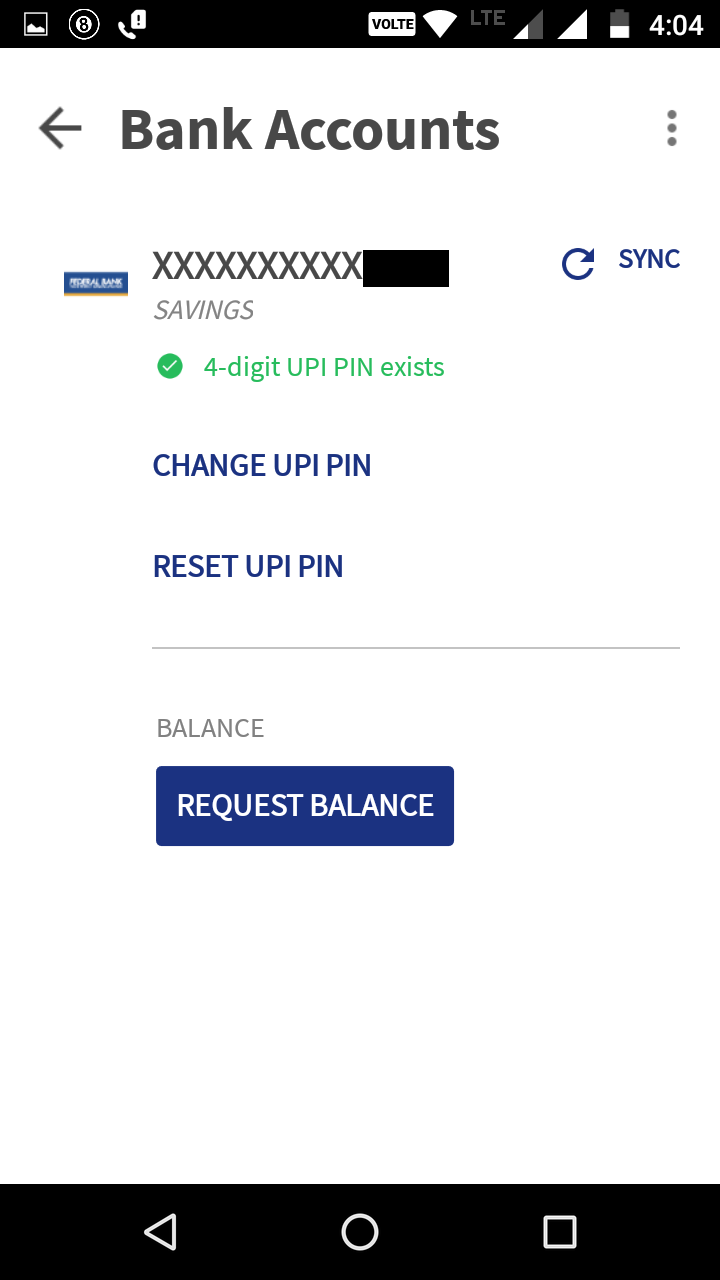

Once your mobile number is successfully verified, your Bank Account will be displayed on screen. Click on Reset UPI Pin to Reset PIN for the first time

Once your mobile number is successfully verified, your Bank Account will be displayed on screen. Click on Reset UPI Pin to Reset PIN for the first time

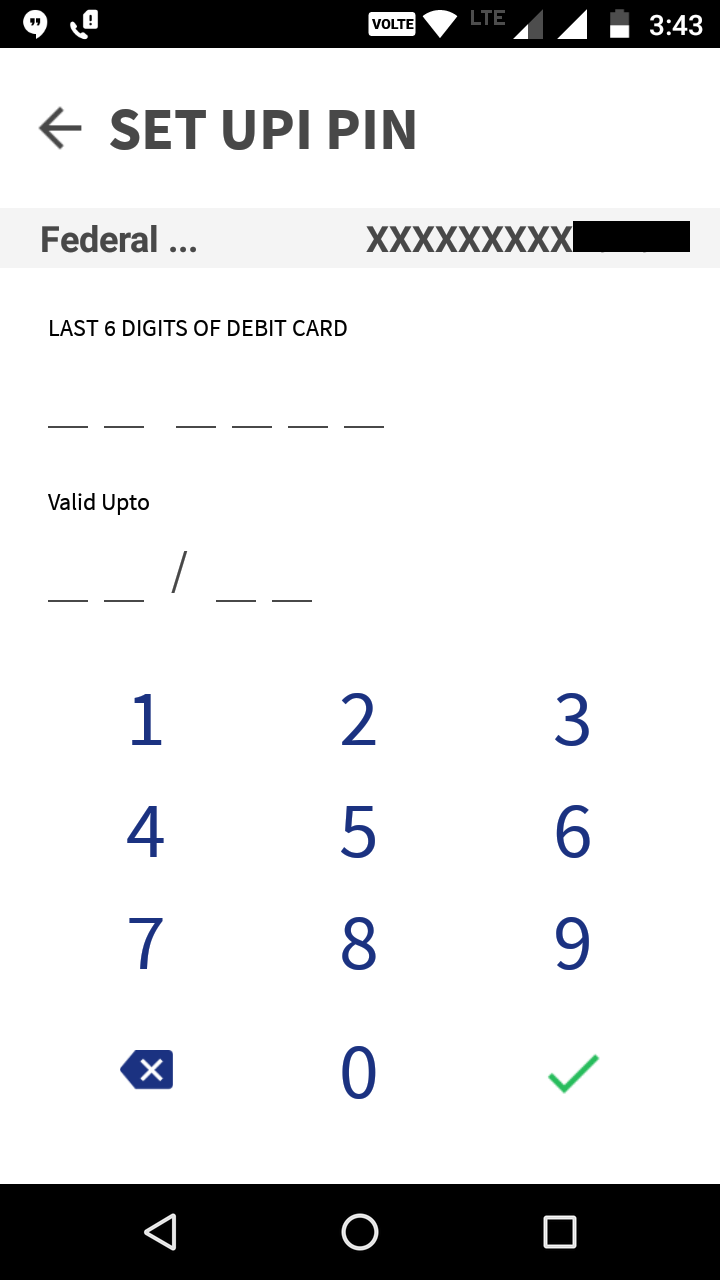

To Setup your UPI PIN, enter the last 6 digits of your Debit Card and also enter the expiration date.

To Setup your UPI PIN, enter the last 6 digits of your Debit Card and also enter the expiration date.

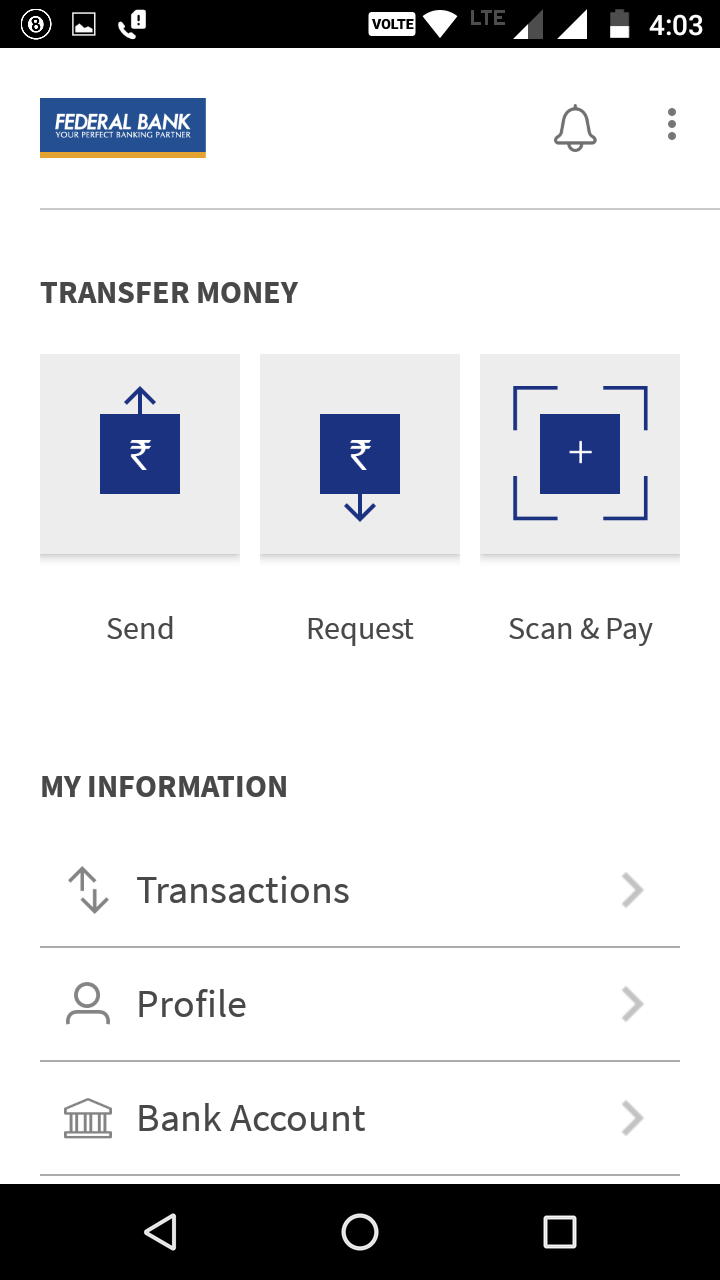

You can directly send money to someone's bank account if you know their number affiliated with their bank account.

Send / Receive Money:

Make Cashless Payments or receive money from friends, family and customers through a mobile number or payment address. Money can also be sent to an unregistered user using Mobile number, Account number +IFSC and Aadhaar Number. You can also collect money by sending a request and reverse payments instantly if required.

Check Balance:

You can check your bank balance and transactions details on the go.

Custom Payment Address:

You can create a custom digital payment address in addition to your phone number.

QR Code:

You can scan a QR code for faster entry of payment addresses. Merchants can easily print their QR Code for display.

Block/ Spam:

You can Block/Spam users who are sending you collect requests from illicit sources.

Pay using Aadhaar:

Make seamless transactions using Aadhaar number.

Transaction Limits:

Per transaction maximum limit of Rs. 10,000

Per day maximum transaction limit of Rs. 20,000

...